Hrithik Roshan’s ₹10.9 Crore Real Estate Investment in Andheri West

By

Shrusti Naik

Posted on December 3, 2025. 10 mins

Celebrities Are Buying Commercial Real Estate - Hrithik Roshan Just Joined the Trend

Introduction

Bollywood’s relationship with Mumbai real estate is deep-rooted, from sea-facing homes in Juhu to luxury penthouses in Worli. But a new trend is unfolding in 2025: celebrities are not just buying lavish residences; they’re turning to commercial properties as stable, long-term investments.

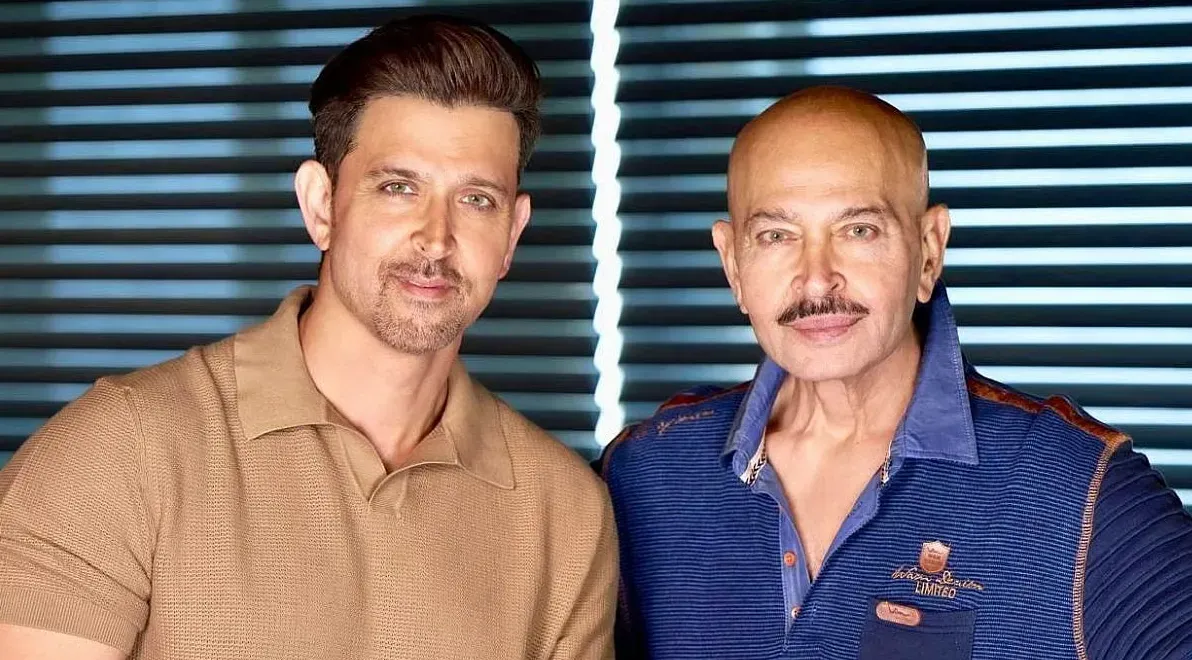

The latest example? Hrithik Roshan and his father Rakesh Roshan, who recently purchased four commercial units worth ₹10.9 crore in Andheri West under their firm, HRX Digitech LLP [1].

Beyond the glamour, the move reflects a larger shift, India’s elite are viewing real estate not just as lifestyle indulgence, but as an income-generating, inflation-hedged asset. Here’s what Hrithik Roshan’s latest buy tells us about Mumbai’s property market, where the opportunities lie, and what retail investors can learn from it.

The Deal: What Hrithik and Rakesh Roshan Bought

According to registration data reviewed by The Economic Times and Moneycontrol, HRX Digitech LLP acquired four office units at Yura Business Park Phase 2 in Andheri West, for a total consideration of ₹10.90 crore [1][2].

| Unit | Carpet Area | Price (₹ crore) | Car Parks |

|---|---|---|---|

| 1 | 852 sq. ft | 3.42 | 2 |

| 2 | 545 sq. ft | 2.19 | 1 |

| 3 | 845 sq. ft | 3.39 | 1 |

| 4 | 473 sq. ft | 1.90 | 1 |

Total investment: ₹10.9 crore Total carpet area: ~2,715 sq. ft Location: Yura Business Park Phase 2, Andheri West

The deal, registered in November 2025, cements Andheri West’s growing reputation as a commercial micro-market that bridges corporate convenience with Bollywood’s creative energy. Read Mumbai Real Estate Prices 2025: Western Suburbs Outlook

Why Andheri West and Why Now

1. A Strategic Commercial Hub

Andheri West is one of Mumbai’s most balanced micro-markets, combining residential density, media and entertainment offices, start-ups, and service businesses. It’s also well-connected via the Metro Line 1, the Western Express Highway, and the Link Road, making it a self-contained ecosystem.

This connectivity and diversity make the area an ideal choice for office spaces catering to production houses, digital firms, and boutique financial consultancies, sectors that have rebounded strongly post-pandemic.

“Andheri West is no longer just a residential suburb; it’s a thriving mixed-use zone,” says a 2025 JLL India report on Mumbai real estate. “Demand for commercial spaces in suburban nodes has risen 18% year-on-year.” [3]

2. Celebrities Are Thinking Like Investors

Celebrities like Kartik Aaryan, Sushmita Sen, and Kajol have all made notable property moves in 2024–25 — not just buying homes but diversifying into commercial assets [4].

- Kajol leased her Goregaon property to HDFC Bank for ₹8.6 crore over nine years [5]. Read Kajol’s ₹8.6 Crore Goregaon Deal: What It Means for Mumbai Real Estate

- Sushmita Sen’s mother bought two luxury flats in Goregaon worth ₹16.9 crore [6].

- Kartik Aaryan’s parents purchased a ₹10.83 crore commercial property in Vile Parle [7].

The common thread? Asset diversification and steady rental income, a hedge against market volatility.

3. Commercial Yields Outperform Residential

As per Knight Frank India’s Q3 2025 Commercial Outlook, average gross rental yields in Mumbai’s office spaces hover around 7–8%, compared to 2.5–3% for residential [8].

With developers offering ready-to-lease inventory, and corporates expanding footprint in suburban nodes, well-selected office assets are emerging as a preferred investment class for both HNIs and institutional investors.

For celebrities with large capital reserves, these returns, combined with capital appreciation, make commercial property a strategic wealth-preservation tool. Also read, 2BHK in Mumbai: Best Localities for Price & Lifestyle 2025

Mumbai Real Estate Snapshot (2025)

| Metric | Value (2025) | Source |

|---|---|---|

| Average citywide price | ₹21,318 per sq. ft (+5% QoQ) | Moneycontrol [2] |

| Property registrations (Jan–Nov 2025) | 1.35 lakh units | ET Realty [9] |

| Mid-segment launches (Q2 2025) | 70% of total new supply | Knight Frank [8] |

| Average commercial yield (Mumbai) | 7–8% | Knight Frank India [8] |

Mumbai’s property market remains resilient. Strong demand, redevelopment projects, and sustained infrastructure spending (such as the Coastal Road and metro expansions) continue to fuel prices, especially in western suburbs.

What the Roshan Deal Signals for Investors

1. Commercial Property Is Back in Vogue

After pandemic-era stagnation, 2024–25 marks a recovery phase. Demand for flexible offices, hybrid setups, and small-format commercial spaces is surging. The Roshan purchase reinforces the market’s maturity, where owning commercial assets is no longer just institutional turf.

2. Western Suburbs Are the New Core

Andheri, Goregaon, and Malad are emerging as the epicentre of both residential and commercial activity. According to Knight Frank’s Mumbai 2030 forecast, nearly 73% of redevelopment-driven housing will come from Western Suburbs [8] which naturally attracts complementary commercial projects. Also check out, The Ins and Outs of Property Management for Landlords: Maximizing Your Rental Income

3. A Signal of Confidence in Physical Assets

With global economic uncertainty, tangible assets like real estate offer a hedge against inflation and currency depreciation. Celebrity purchases often amplify this sentiment, influencing both public perception and market confidence.

Risks and Considerations

While commercial investments look promising, they require careful due diligence:

- Liquidity Risk: Office spaces are harder to resell than residential units.

- Regulatory Scrutiny: Investors must ensure RERA compliance, occupancy certificate (OC) status, and clear title.

- Maintenance & Vacancy: Rental yields can drop if vacancy periods are long or if tenant quality declines.

- Tax Implications: Rental income from commercial assets is taxed as “income from house property.” Investors should consult professionals on deductions and GST applicability.

Also read, What Salary to Afford a 2BHK in Mumbai in 2025

Actionable Takeaways for Buyers

| Buyer Type | Suggested Strategy |

|---|---|

| HNIs / Celebrities | Diversify into high-demand commercial hubs with mixed-use development potential. |

| Mid-income investors | Consider fractional ownership in Grade-A commercial properties or REITs for exposure. |

| Home-buyers | Redevelopment-heavy suburbs like Andheri or Goregaon can offer better long-term appreciation. |

| NRIs | Focus on RERA-registered, income-generating commercial assets with stable tenancy. |

Conclusion

Hrithik Roshan’s ₹10.9 crore investment is more than a celebrity headline, it’s a signal of confidence in Mumbai’s commercial real estate cycle.

The Western Suburbs, especially Andheri West, are evolving into integrated live-work zones, where entertainment, business, and lifestyle intersect. For India’s new-age investors, this represents an inflection point: real estate isn’t just a luxury, it’s strategy.

As more high-profile names diversify into commercial property, one thing is clear, the star power in Mumbai’s skyline isn’t limited to billboards anymore.

Key Stats (2025 Snapshot)

| Category | Data |

|---|---|

| Hrithik Roshan Deal Value | ₹10.9 crore |

| Property Type | Commercial offices |

| Location | Andheri West, Mumbai |

| Average Mumbai Property Price | ₹21,318/sq. ft |

| Commercial Yield | 7–8% per annum |

| Total Mumbai Registrations (2025 YTD) | 1.35 lakh |

| Redevelopment-driven New Homes (2030 target) | 32,000+ units |

| Source | ET Realty, Moneycontrol, Knight Frank, JLL India (2025) |

Frequently Asked Questions

1. Why are celebrities investing in commercial real estate now? Because commercial spaces offer higher yields (7–8%) and stronger long-term stability compared to residential assets. They’re also easier to lease to corporate tenants.

2. Is Andheri West a good investment location in 2025? Yes. It’s among the top-performing western suburbs with strong infrastructure, metro connectivity, and growing commercial demand.

3. How can small investors participate in commercial property? Through fractional real estate platforms or REITs (Real Estate Investment Trusts), which allow smaller ticket sizes.

4. What taxes apply to commercial property owners in India? Rental income is taxable under “Income from House Property.” GST may apply to leased commercial units, and capital gains tax is levied upon sale.

5. Will celebrity investments like Hrithik Roshan’s inflate prices? Not directly, but they influence sentiment. Investors and developers often view such high-profile deals as endorsements of a location’s growth potential.

References

- “Hrithik Roshan, Rakesh Roshan buy property worth ₹10.90 crore in Mumbai’s Andheri West,” Economic Times, Dec 2025.

- “Roshan duo acquires four commercial units worth ₹10.9 cr,” Moneycontrol, Dec 2025.

- “Top 10 Residential Areas to Invest in 2025: Mumbai Edition,” JLL India, Nov 2025.

- “Celebrities Betting Big on Indian Real Estate,” JLL Homes Blog, Jul 2025.

- “Kajol leases Goregaon property to HDFC Bank,” Hindustan Times, Nov 2025.

- “Sushmita Sen’s mother buys two luxury flats in Goregaon,” Times of India, Nov 2025.

- “Kartik Aaryan’s parents purchase commercial property in Vile Parle,” TOI, Nov 2025.

- “India Real Estate: Office Market Update Q3 2025,” Knight Frank India, Sep 2025.

- “Mumbai property registrations mark best Nov since 2013,” ET Realty, Dec 2025.